7 Strategies to Recession-Proof Your Business

A Christian Business Leader’s Guide to Prepare for Economic Recession

These are tumultuous times. Talk of an economic recession is on the rise. Banks are failing. While unemployment remains low, business owners in every industry are grappling with rising inflation, surging energy and labor costs, skyrocketing interest rates, and a plummeting global stock market. Knowing that 17% of companies failed to survive the past three recessions, wise leaders will prepare their companies to ensure survival in the next one.

With financial pessimism rising and economic dashboards simultaneously flashing red and green lights, how will we brave these rough waters and steer our businesses to thrive? And how might biblical wisdom guide us in these times?

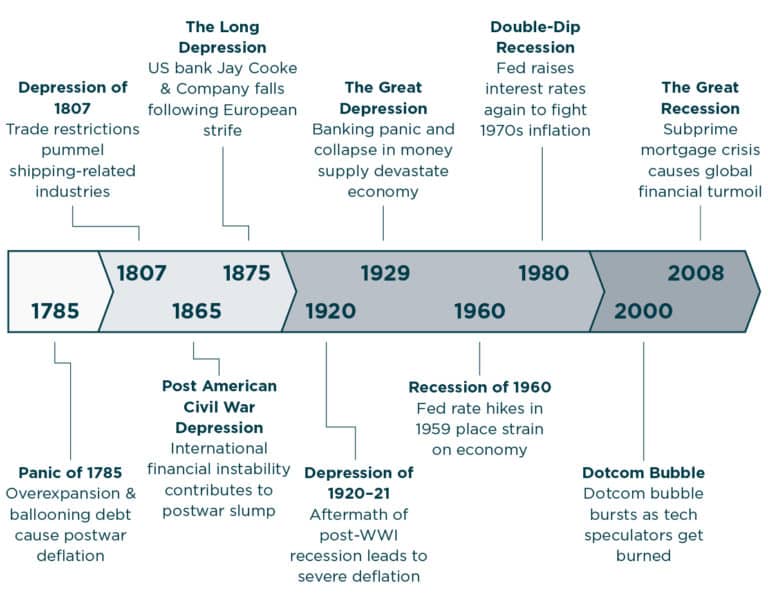

Economists define an economic recession as two consecutive quarters of negative growth that typically last between 8 and 18 months. Each recessionary period has unique business factors, and the challenges we face in 2023 may follow different patterns than previous cycles.

As we consider strategies for leading through economic recession, it is helpful to remember that downturns are a regular part of the business cycle.

Historical trend data indicates that specific sectors tend to be more affected than others during such times, making it critical for business owners to be aware of their industry’s vulnerability to economic downtowns.

Knowing the relative risks to our industries will help us prepare for possible challenges on the horizon. Preparation can mitigate the negative impact of an economic recession on our companies and those who we serve.

Economic Recession and Biblical Stewardship

In 2007, Lee Arnold, C12 member and CEO of Secured Investment Corp, was riding the winds of a real estate bull market. When the economic winds shifted, Lee lost everything. He committed to rebuilding in a new way based on God’s principles. With talk of economic recession in the air again, he is in a position to successfully navigate any headwinds that come his way. Watch this video to learn how Lee gained a new perspective on biblical stewardship.

God calls us to steward everything that He has entrusted to us—and that includes our businesses. Good financial stewardship will help our businesses be prepared for an economic recession and equip us to continue to serve customers with excellence. We may even be able to capitalize on opportunities that often arise in recessionary times.

How To Prepare for Economic Recession

7 Strategies to Recession-Proof Your Business

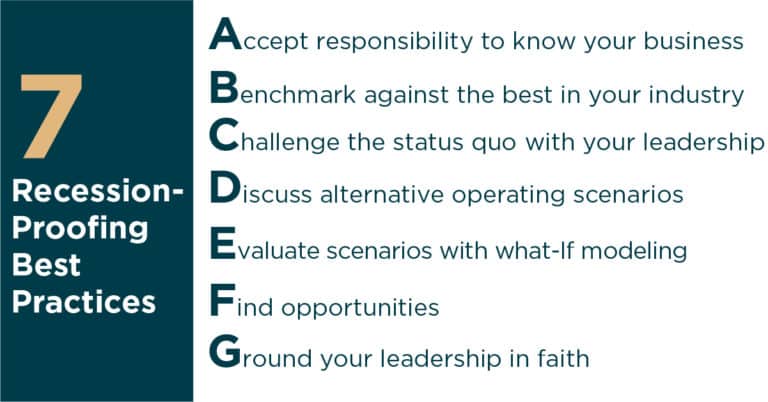

In the face of economic headwinds, wise leaders will step up their readiness and stave off fear. Randy Warwick, a C12 Chair in Cincinnati, Ohio, developed a checklist of seven best practices to prepare for economic recession. By using these best practices, we can confidently lead our companies through tough economic times.

When a recession seems imminent, commit to monitoring and understanding the key financial metrics that drive our businesses. By definition, an economic recession creates a volatile, uncertain, complex, and ambiguous (VUCA) environment.

In VUCA environments, a strong understanding of key financial metrics is essential for making informed decisions and staying ahead of challenges as they arise. Knowing our numbers allows us to stay focused on what truly matters and enables us to make data-driven decisions that can positively impact our businesses:

- Review financial statements more frequently than you do in non-recessionary times – possibly in the middle and at the end of each month. Spend time with an accountant to fully understand the data. Be brutally honest about the economic risks of your business as well as your strengths.

- Keep a close eye on cash flow. Ready cash is the oxygen that small businesses need to survive. In the words of Jack Stack, “The balance sheet is the company’s thermometer. It lets you know whether you’re healthy or not.”

- Assess whether debt is becoming a significant risk. Work with financial advisors, banks, and lenders in total transparency. If necessary, you often will be able to renegotiate terms.

When faced with economic challenges, sometimes we forget that we are not alone. Likely, other firms in our industries are experiencing similar struggles. To benchmark ourselves against our peers, we can:

- Stay up to date with trends in industry trade publications.

- Reach out to other organizations in our industries. C12’s Business and Industry Forums can connect you with peers who are experiencing similar challenges.

- Learn what best-practice competitors are doing in this economic environment.

In C12, we encourage members to lead like the “Buffalo”. Buffalo bravely walk into the storm and resist the urge to cower in fear.

Buffalo leaders lean into hard conversations with their teams. Commit to being transparent about the financial condition of the company. Our teams will play a critical role in both generating revenue and cutting costs. Scheduling recurring meetings to discuss real-time updates will also decrease anxiety.

When the business is facing challenges, we must exercise leadership by exploring ways to reduce expenses and streamline processes. In less difficult times, it can be easy to justify spending money on things that are nice but not necessary. Simplify your focus to activities that save money, reduce risk, and drive profit. Evaluate the contribution margin for each product line. Cut nonessential activities and eliminate “sacred cows.”

As we prepare for a possible recession, alignment is key. We must discuss alternative operating scenarios with our leadership and financial teams, considering the impact each would have on our capacity, costs, and staffing.

There are three primary ways we can respond to economic pressure:

1) Maintain Current Market Share. We can use available retained earnings (and possibly some borrowing capacity) to survive and retain talent.

2) Reduce Overhead to Get in Line with Sales. We can create a plan that is conservative on sales growth, reduces overhead, and cuts nonessential services.

3) Acquire Market Share. Businesses struggling in our industries may become available for acquisition. Acting on such opportunities will require using existing reserves and possibly additional financing.

Each response has different risks and rewards. As a leadership team, discuss the potential upside and downside of each option.

After identifying different alternative operating scenarios, evaluate your options by conducting scenario-based modeling. Modeling allows us to pre-determine decisions in advance of the economic storm. In her article Business Recovery and Continuity: Planning for Multiple Scenarios, Cindy Larson says, “If you’re able to pause during the crisis … you’ll be better prepared to outperform businesses that wait to adjust.”

C12’s Scenario-Based Stress Test tool provides a framework for business leaders to conduct a what-if modeling discussion. Download the tool to ideate solutions in a best-case, middle-case, and worst-case scenario.

While an economic recession devastates some, it can also present unexpected opportunities for the well-prepared. If your company is in a healthy financial position, a recession may create opportunities to…

- Acquire Talent. Downturns present opportunities for us to access candidates who were not recruitable before. Business executives are often attracted to financially stable companies and a positive work environment anchored in biblical hope.

- Acquire Assets. Downturns present opportunities to purchase assets at a discount from competitors forced to liquidate.

- Acquire Customers. Downturns present opportunities to acquire new customers when competitors raise prices or diminish services.

- Acquire Businesses. Downturns may allow us to buy a competitor’s business at a value price.

As Christian business leaders, we have an advantage that our secular colleagues do not. We have faith in a God who knows our needs and has promised to guide us when we humbly seek Him. None of us know what the future holds, but we have a friend who does—Jesus. When we draw close to Him daily, we will learn to hear His voice over the voice of discouragement.

We must stay realistic, not living in denial or fear. As stewards of our businesses, we must remember the apostle’s words, “God gave us a spirit not of fear but of power and love and self-control” (2 Tim. 1:7), and then implement a plan to pursue that scenario in our operations.

Be encouraged. C12 CEOs have not only survived but thrived when facing recessionary times. They attribute their success to a close connection with God, a mission statement rooted in faith, and the strength of a peer community. While each realized that facing the storm was the only way forward, they didn’t go through it alone.

Wise Financial Decisions Today

All businesses will face economic headwinds at some time and in some way. While economic recessions are unavoidable, we must remember the antidote to VUCA is also VUCA.

CEOs and business owners improve the likelihood of navigating a crisis tomorrow by preparing for it today. Instead of succumbing to a victim mentality, prudent decision-making will prepare our companies for inevitable financial ups and downs.

As we say in C12, “No Margin, No Mission”. Advanced decision-making and faith-centered leadership will help our businesses to thrive in the midst of an economic recession. We will be able to bless those we serve. With preparation, we can enter the storm with confidence, leaning into faith over fear.

At C12, we provide Christian business leaders, CEOs, and business owners with the business tools, peer advisory groups, and executive coaching they need to thrive in business and life. To learn more about C12’s approach to Christ-centered business leadership, find a C12 Business Forum near you.

March 13, 2023