The Tricky Proposition of Value-Based Pricing

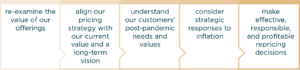

Responding to an Inflationary Market

It is hard to overstate the benefits of value-pricing, especially in inflationary markets. As all business owners can attest: pricing can be a tricky proposition. Overprice and you risk losing customers. Underprice and you leave money on the table. Research shows businesses that implement value-based pricing strategies will be well-positioned to thrive. Joan Johnson’s story illustrates common challenges.

Joan Johnson owns Greenstone Bed & Breakfast, a 30-room historic inn in Saugatuck, Michigan. Saugatuck is located in Southwestern Michigan and is known for sand dunes, sunsets, farm-to-table cuisine, and local artisans. Joan is a winsome Christian, and many of her customers are pastors, youth leaders, or retirees seeking a weekend retreat from city life. They return time and time again to experience the rest and retreat offered at Greenstone. While Saugatuck experiences most of its tourism throughout the summer, its most popular season occurs during three consecutive weekends in the fall during the city-wide art festival and at the height of fall colors.

Joan has struggled with pricing. In the past year, her expenses have increased as labor and food costs experienced record inflation. It seems clear that she should raise her prices, but how? She wonders about the ethics of price increases and how they might affect her less affluent customers.

Her nearest competitors are chain hotels that offer standard rooms and complimentary breakfast but do not offer the historic charm or personalized niceties of Greenstone. Joan wonders whether she should price her rooms at a comparable rate to those other hotels. Or is the experience at Greenstone worth more? And if so, how much more? How much are her peak weekends really worth?

The Importance of Pricing Right

Around the world, business leaders are grappling with how to respond to the inflationary market. And it’s easy to feel trapped between two less-than-optimal options.

- Raising prices with the risk of damaging customer relationships

- Maintaining prices with the risk of eroding profitability

It’s important to think strategically about our pricing. Determining the right pricing strategy is one of the most effective ways to reach our ideal profitability.

As a McKinsey report highlights, effective pricing strategies can deliver a 2-to-7 percent increase in return on sales—offering a powerful measure of control in an inflationary market and beyond.

If we want to adopt a more strategic pricing solution, the steps below provide a path forward. Value-based pricing aims to leverage the value we offer our customers to grow revenue. Its benefits are felt beyond the bottom line as we seek to be good stewards of our businesses.

Value-Based Pricing

A Biblical Perspective on Pricing

It may seem logical to set prices according to customer expectations and industry practices. Capitalism defines this as “what the market will bear.” But it is naïve to believe the market will moderate this tension consistently and justly.

For Christian capitalists interested in serving others while building a loyal customer base, God’s Word is clear that we are to use honest weights and measures (Prov. 11:1, 16:8, 16:11, and 20:23). New Testament scholar Wayne Grudem suggests that “profit is … an indication that we have made something useful for others.” Such profit should reflect the value of our time, skill, and risk.

“Profit is an indication that we have made something useful for others.”

–Dr. Wayne Grudem

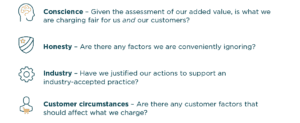

So as we seek to love God and pursue a profitable pricing strategy, the following considerations will help us navigate potential issues:

Pricing for Value, not Cost

Most companies tend to set prices in one of two ways: 1) cost plus a target margin, or 2) competitive pricing and living with the resulting margin.

While these methods work, they can leave money on the table, erode brand value, and create openings for competitors.

Value-based pricing offers a more powerful model for pricing, profitability, and performance. Using this method, we justify our pricing by:

- Providing high value

- Knowing that value

- Communicating it well and consistently to our customers

- Confirming that our customers agree with the value exchange

When we employ value-based pricing, we can more accurately determine the value we exchange with our customers. The result: we likely have more bargaining power than we realize.

Different Customers Value Different Things

Thomas T. Nagel and Georg Muller, in their book The Strategy and Tactics of Pricing, suggest that we re-examine our value offering with questions such as:

- At what price would our product be so expensive a customer would not consider buying it?

- At what price would our product be so inexpensive the customer would question its value?

- What price would be the most acceptable price to pay?

- How will we segment the market and offer different value propositions to each segment?

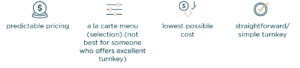

These questions start to explore the value exchanged with our customers—the value we offer them and the value they offer us in return. Value-based pricing recognizes that different customers value different things—or value the same things differently. Such knowledge supports our pricing power with the potential for higher margins.

Consider, for example, the different ways we can offer our products and services.

By understanding what our customers value, we can make adjustments if necessary and set prices accordingly.

Increasing Price: Gains & Losses

But if we raise prices, won’t we lose customers?

Most business owners are surprised to learn that even a small increase in price can lead to a significant increase in profits.

“1% increase in prices, on average, translates into an 8.7% increase in operating profits (assuming no loss in volumes) for US firms.” According to McKinsey report cited in toptal.

Inevitably some customers will leave, but even if they do, the resulting increase in profit often makes up for the loss. Understanding the “break-even” of additional sales required to make up for a discounted price—or the number of customers we are willing to lose while still coming out ahead should we increase prices—helps ensure worthwhile trade-offs. Considering the implications of taking prices up or down gives us some guardrails within which to make informed pricing decisions.

Value-Based Pricing for a Variety of Customers

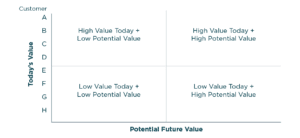

Do your customers offer equal value to your business?

When looking through the lens of profitability, the answer is “not necessarily.” Some customers offer more value back to a company than others in terms of their current and long-term investment in its products or services.

Variable pricing seeks to optimize the relationship by offering different pricing, perks, or levels of service for different customers.

Pete Hayes from fractional CMO firm Chief Outsiders describes a valuable exercise business leaders can use to develop a long-range pricing plan based on the value different customers bring to the business.

He segments customers across four quadrants, weighing their value to the business today against their market potential for tomorrow. These insights can help us devise different pricing strategies for different types of customers.

Consider the following actions for different types of customers:

High Current Value/High Future Value (Top Right):

- These are your platinum opportunities: give them dedicated sales and support people to make their experience with you outstanding.

High Current Value/Low Future Value (Top Left):

- Consider modest price increases to maximize profitability, and develop a strategy to incentivize future referrals.

Low Current Value/High Future Value (Bottom Right):

- Consider a discount program or value contract strategy to increase future sales.

Low Current Value/Low Future Value (Bottom Left):

- Increase prices now, or consider pruning due to low value.

Before we move forward—a cautionary note. Pricing can work both ways, as McKinsey points out. It is “the most powerful lever for driving or destroying the operating margins of a company.” Times of inflation especially call for nuanced approaches if we want to strengthen our margins and customer relationships.

To mitigate common pricing management mistakes, C12 has summarized 12 Pricing Management Best Practices into a FREE downloadable resource:

Communicating a Price Adjustment to Your Customers

Entering conversations about price increases is never easy. If we communicate poorly, we risk undermining our relationships, reputation, and desired results. If we communicate well, we can optimize the value exchange and strengthen relationships.

Customer reaction to a price increase comes down to their beliefs. Do they believe the price is justified? Do they believe the price is fair?

When we communicate with customers about a pricing increase, we must ensure our rationale aligns with what they value. Some best practices include:

- Arm the sales team with robust data and analytics on the why behind any change.

- Design and customize communication-based on product-specific attributes and price points.

- Anchor the conversation in the context of value amid the current macroeconomic environment.

- Provide insights, scenarios, and potential impacts (including benefits) for consumer economics.

Value-Based Pricing: Bringing it All Together

Joan brought her pricing questions to her C12 Business Forum for peer counsel. Based upon input from her peers, she realized that Greenwood offered “rest and retreat,” not just a “bed to sleep in.” Rest and retreat are of incredibly high value to her customers. And she realized it was good stewardship to base her prices based on what her customers valued—not just cost or competitive analysis.

Further, by under-pricing her rooms, she was leaving money on the table. Lower profits meant she was unable to bless her employees with the higher wages they deserved and to bless the causes she cared about. As we say in C12, “No margin, no mission.” Joan decided to increase pricing based on the input of her peers.

In an inflationary market, companies that base prices on cost and competition are under threat. To be good stewards of God’s resources in these times requires us to provide high value, know that value, and communicate it well and consistently to our customers.

Well-positioned value-based pricing will allow us to provide a flourishing work environment and advance our mission sustainably.

At C12, we provide Christian business leaders, CEOs, and business owners with the business tools, peer advisory groups, and executive coaching they need to thrive in business and life. To learn more about C12’s approach to Christ-centered business leadership, find a C12 Business Forum near you.

November 15, 2022